Applying for an Employer Identification Number (EIN)

Applying for an employer identification number is the most secure way to get paid by any employer. They’re FREE and offer a lot of additional protection for both Tidy Casa and everyone we’re working with.

Benefits include:

- File business taxes and avoid penalties

- Prevent identity theft

- Adds credibility as an independent contractor

- Speeds up business loan applications

- Allows for opening a business bank account

- Builds trust with vendors

- Helps establish business credit

- Easier to hire employees

- Get more options as an overseas entrepreneur

Did we mention it’s FREE?

Information on how to sign up can be found here: https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Here’s how to set up an EIN number

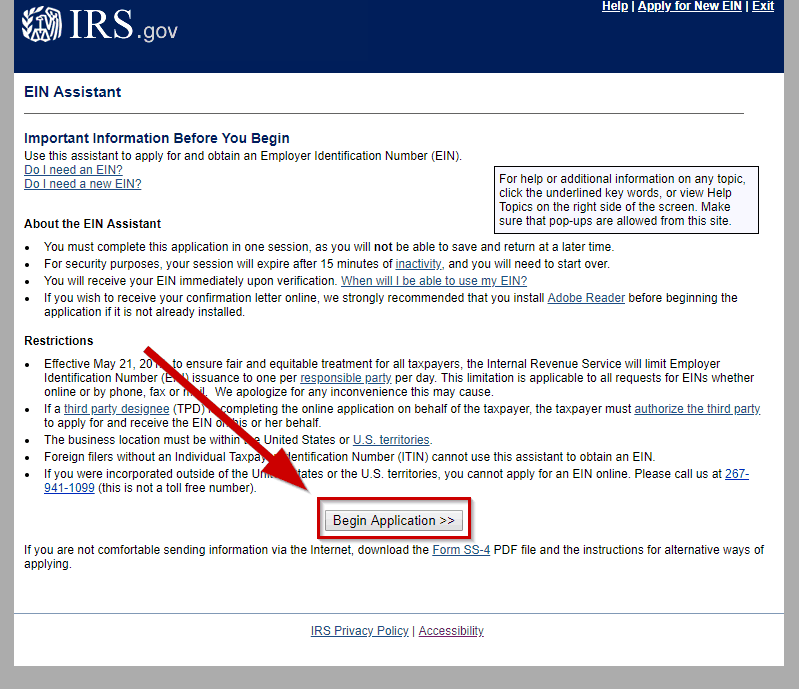

Start by going to https://sa.www4.irs.gov/modiein/individual/index.jsp

STEP 1

Once there click the “Begin Application” button.

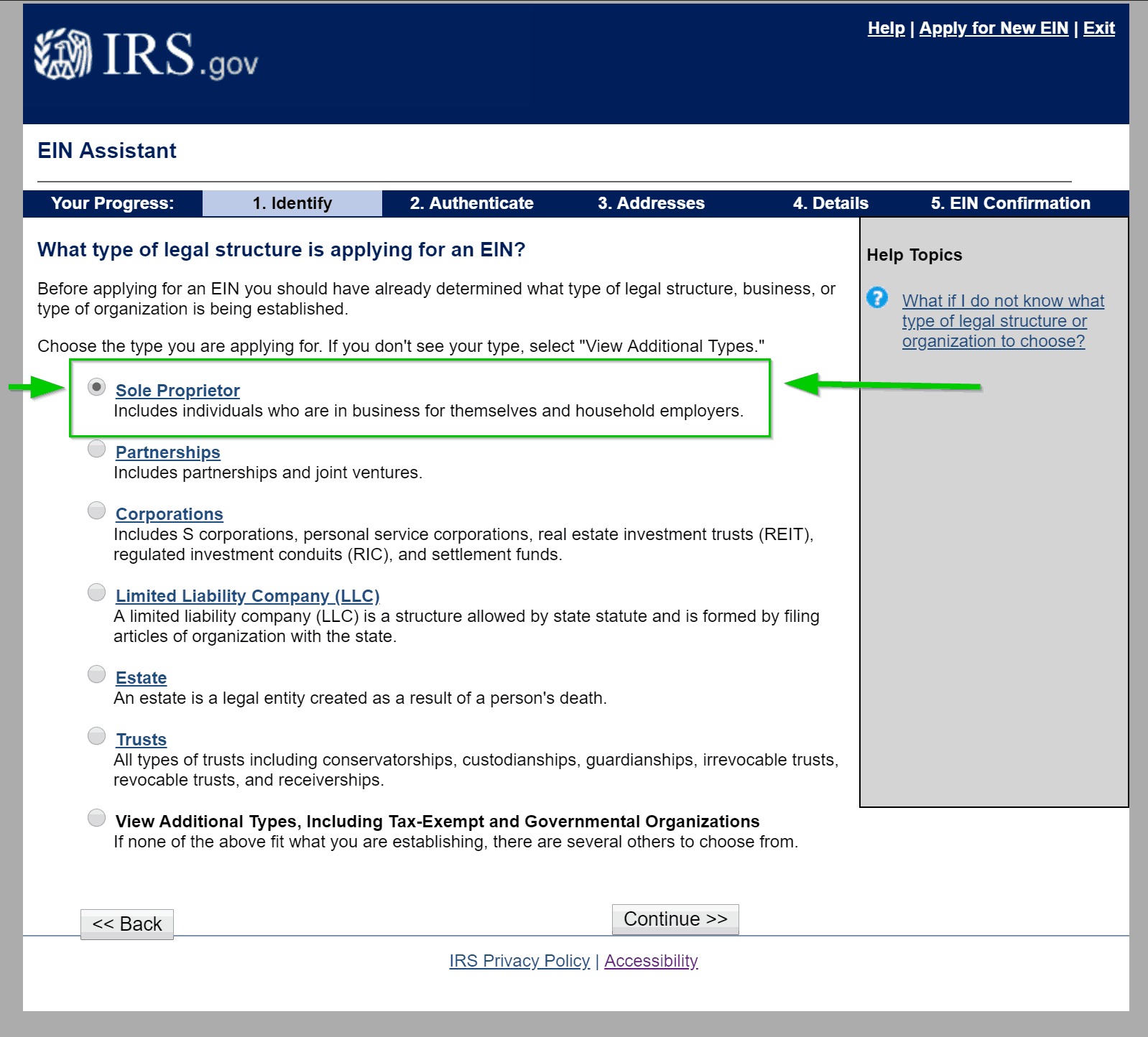

STEP 2

Select the business type your using. For most people, this will be “Sole Proprietor.” Then, hit continue.

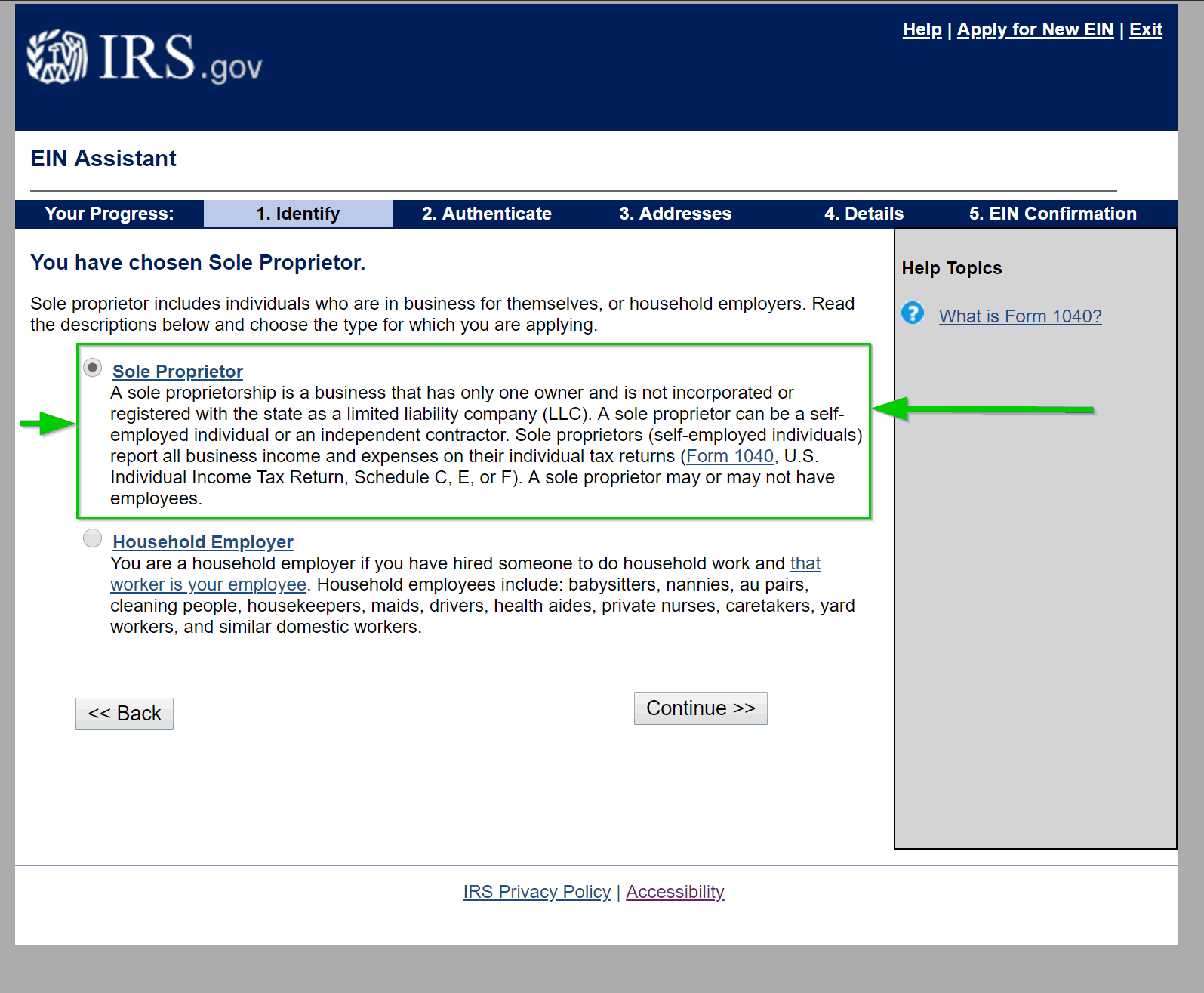

STEP 3

On the next page select “Sole Proprietor” again. Then, hit continue.

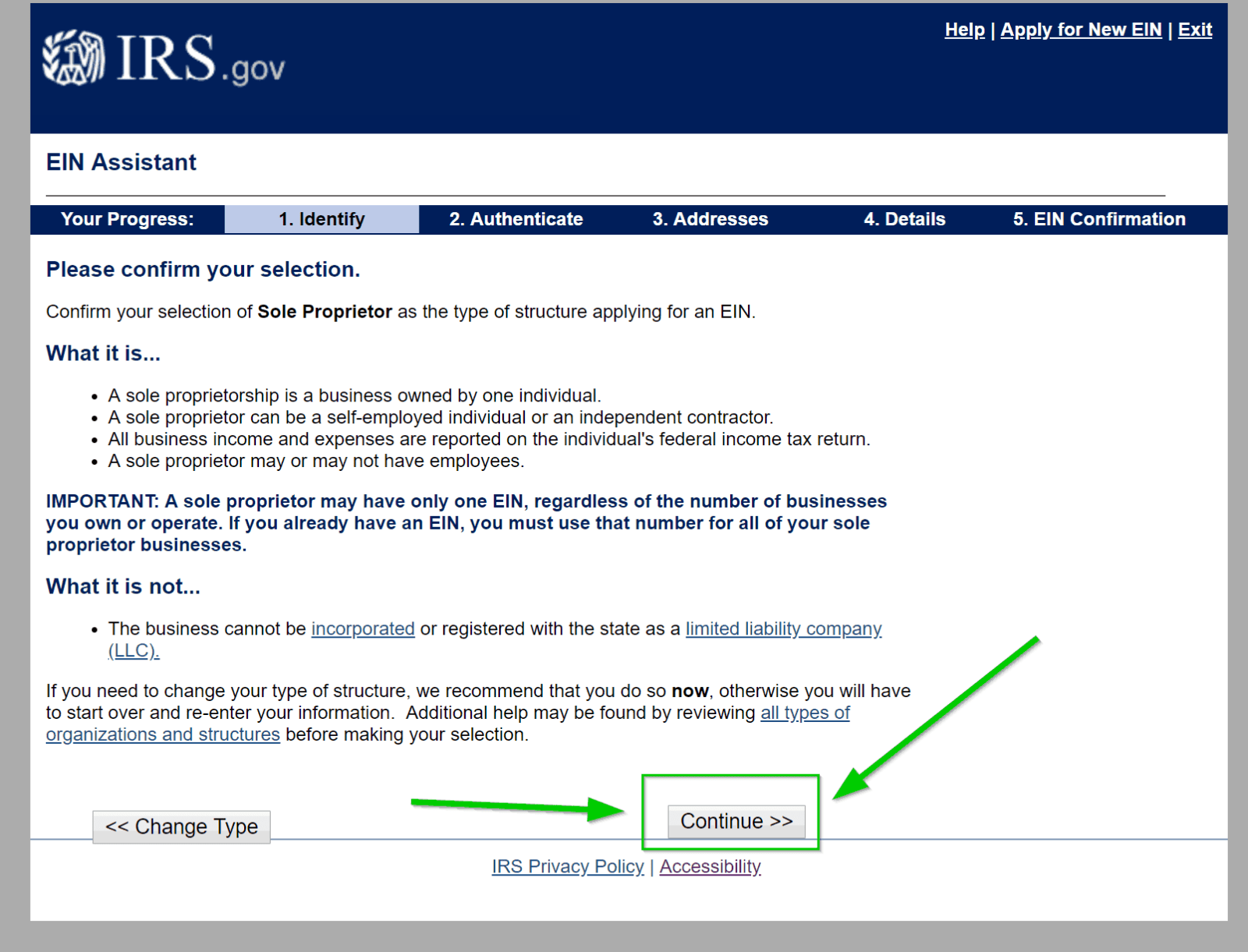

STEP 4

On the next page, review the information provided and make sure it matches how you run your business.

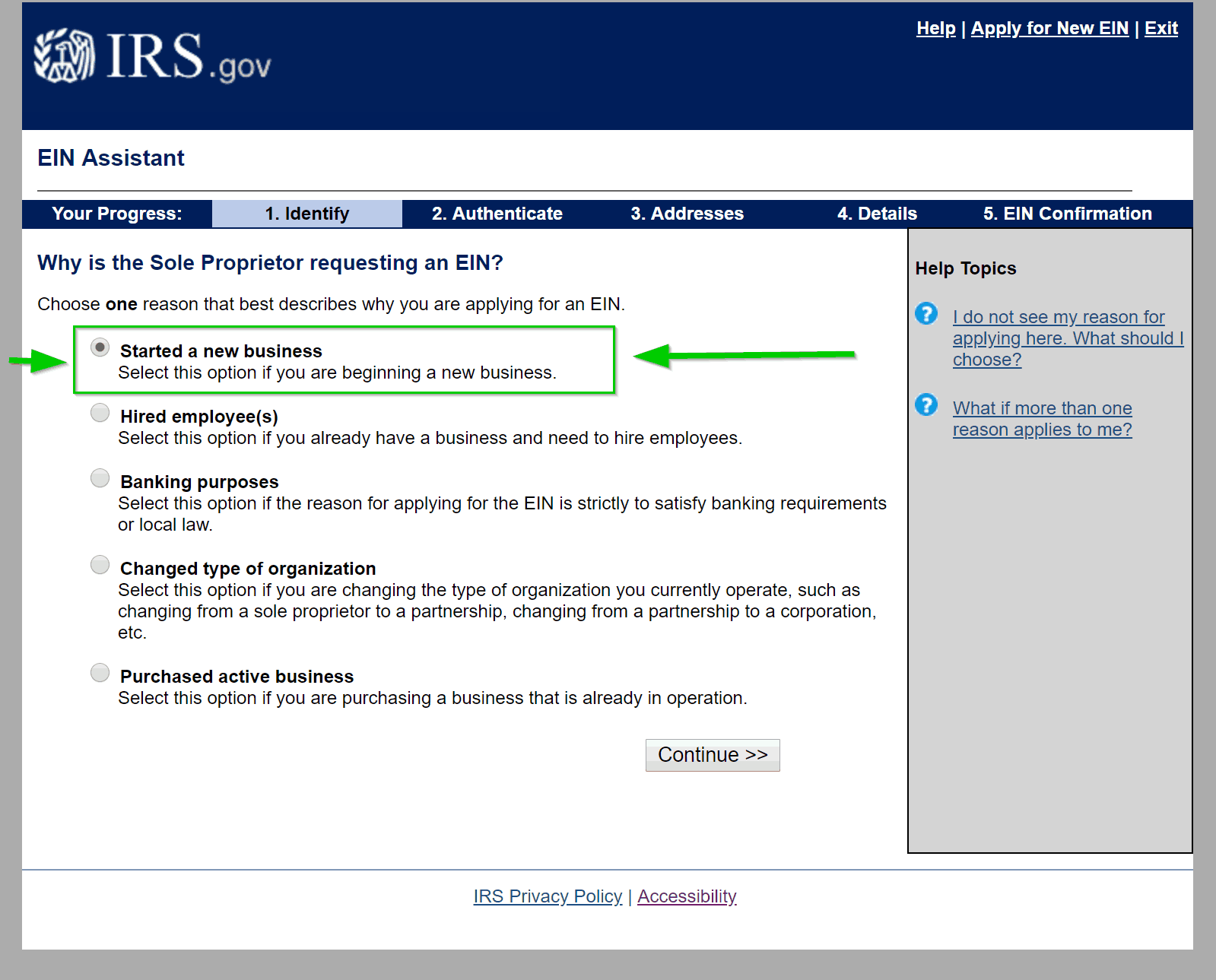

STEP 5

On the next page, select “Started a new business” as the reason for applying for the EIN.

STEP 6

On the next page, fill out your personal information. Select “I am the sole proprietor” and hit “Continue.”

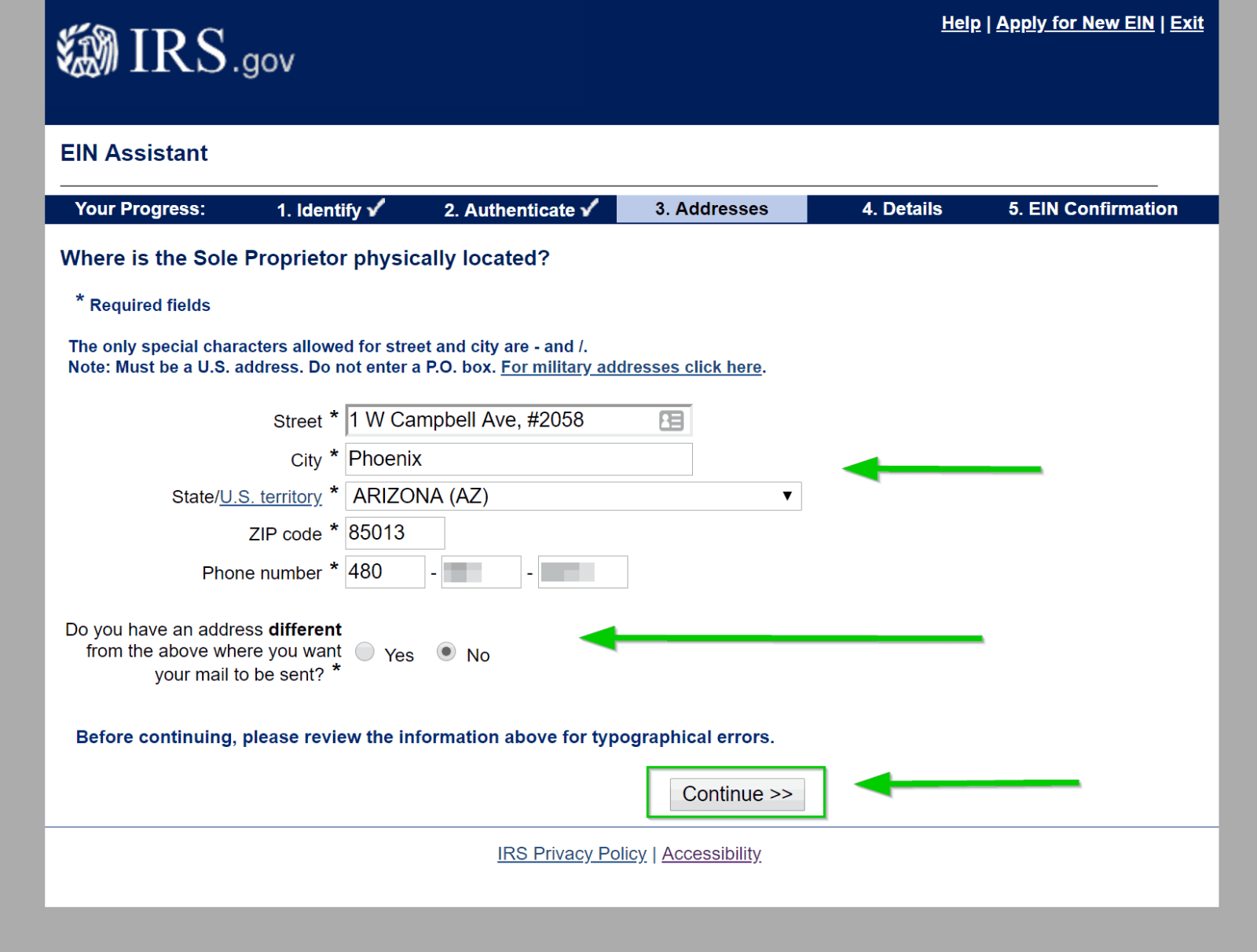

STEP 7

On the next page fill out your address and mailing information. Then, hit continue on the next page.

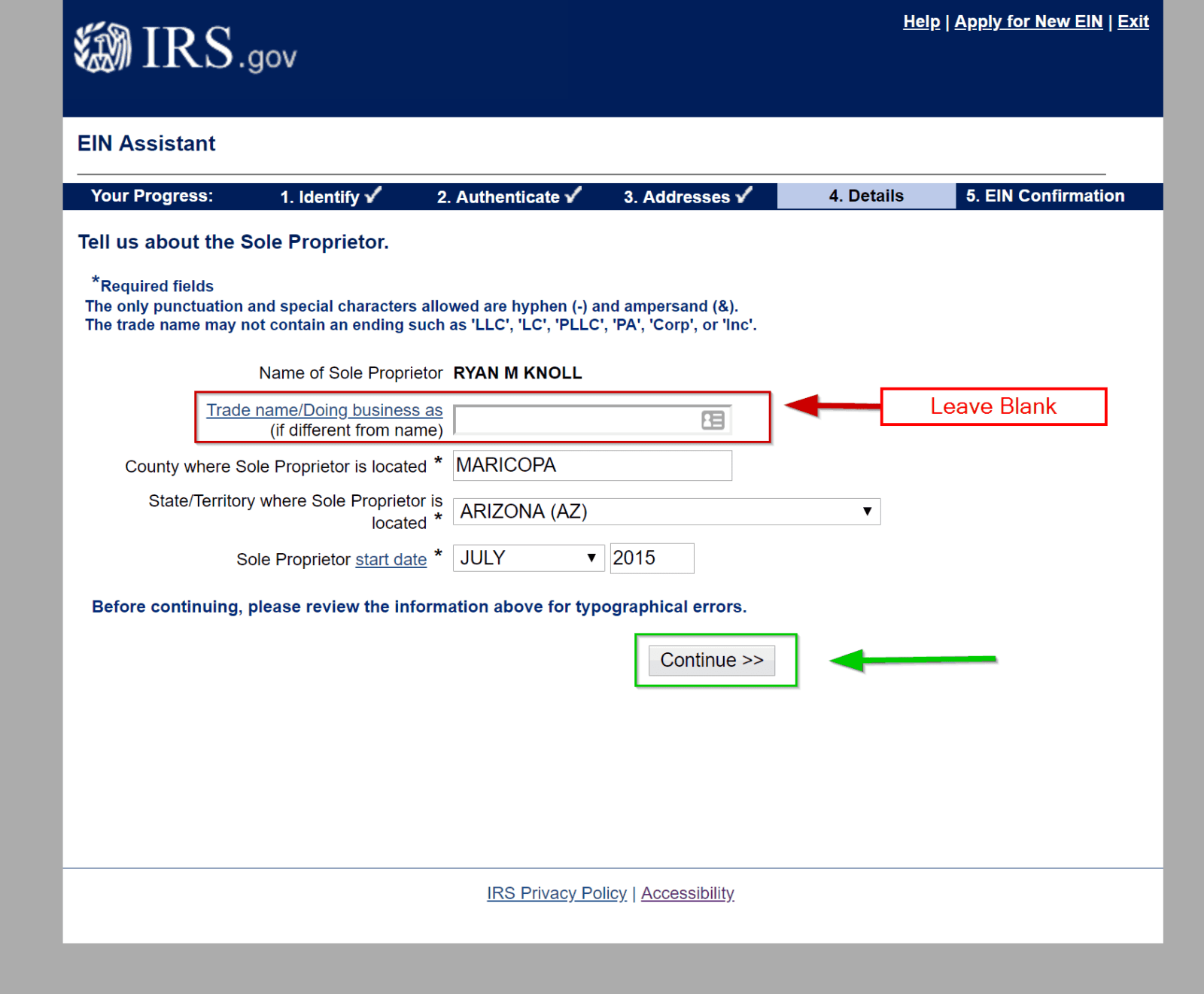

STEP 8

On the next page, verify the county is set correctly and add your start date. That date should be when you started cleaning. This doesn’t have to be 100% accurate if you can’t remember. Make your best guess.

NOTE: Most people will leave the Trade Name blank.

Continue to the next page.

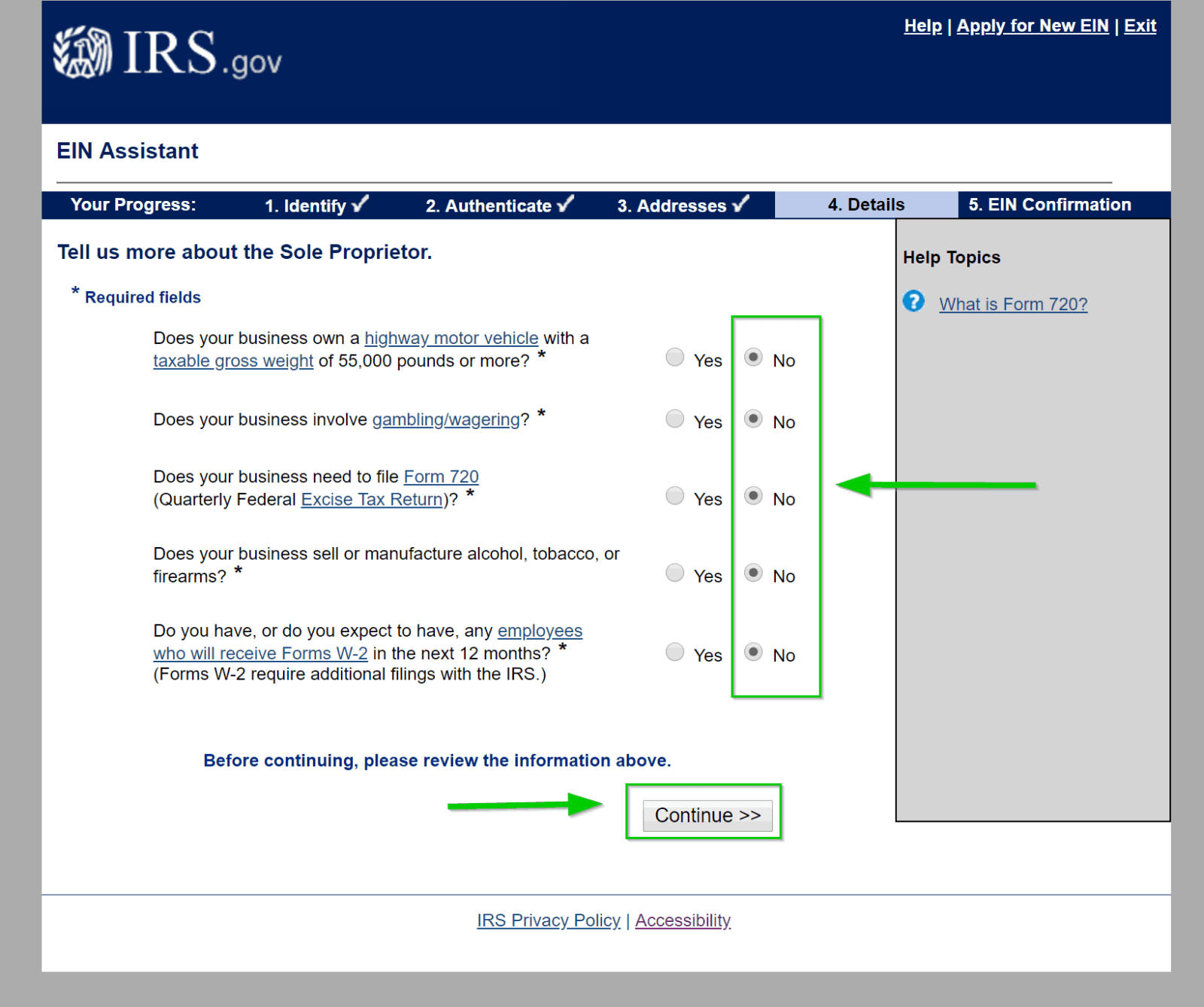

STEP 9

Select “No” for all the questions on the next page.

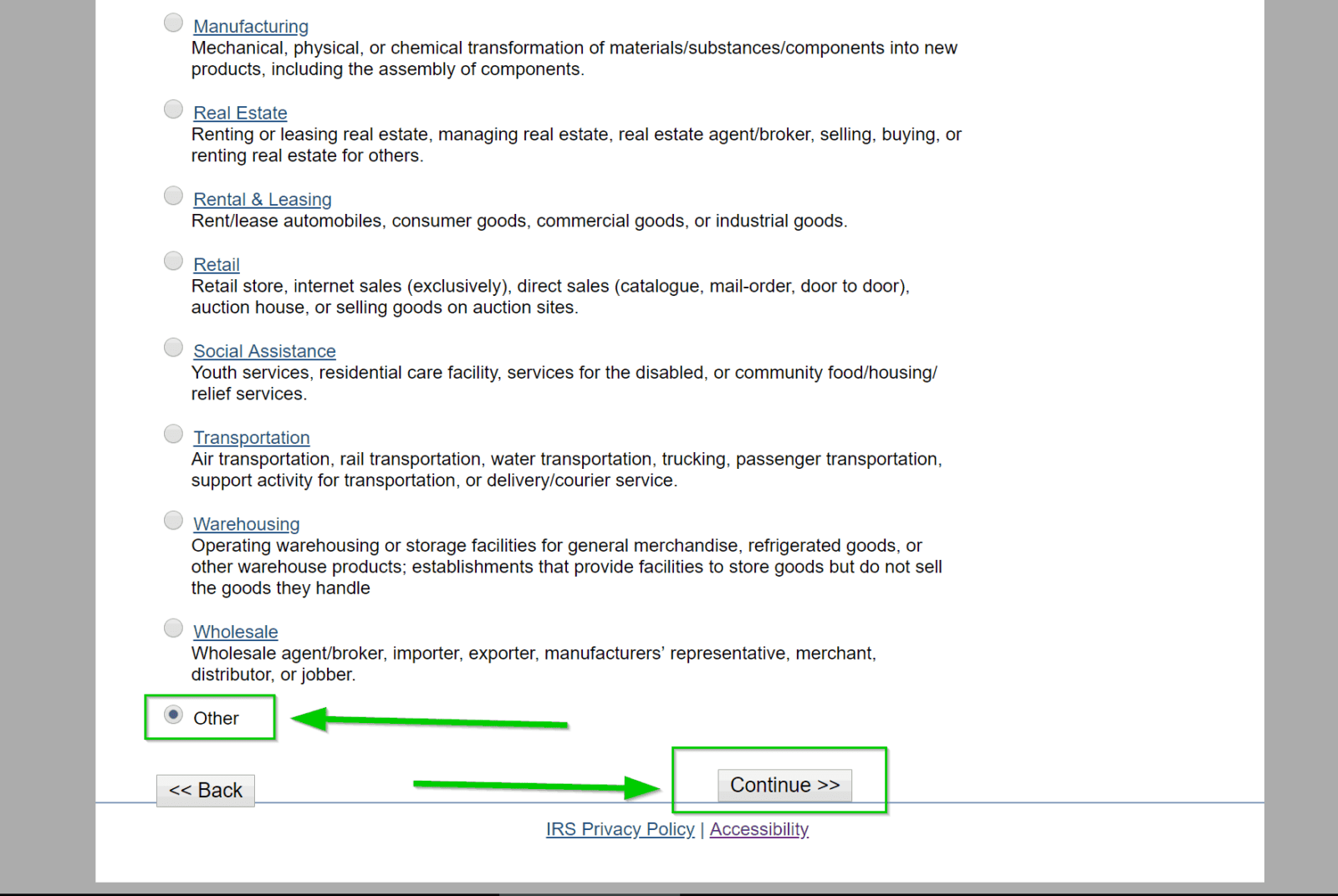

STEP 10

On the next page where it asks “What does your business or organization do?” Scroll to the bottom of the page and select “Other.”

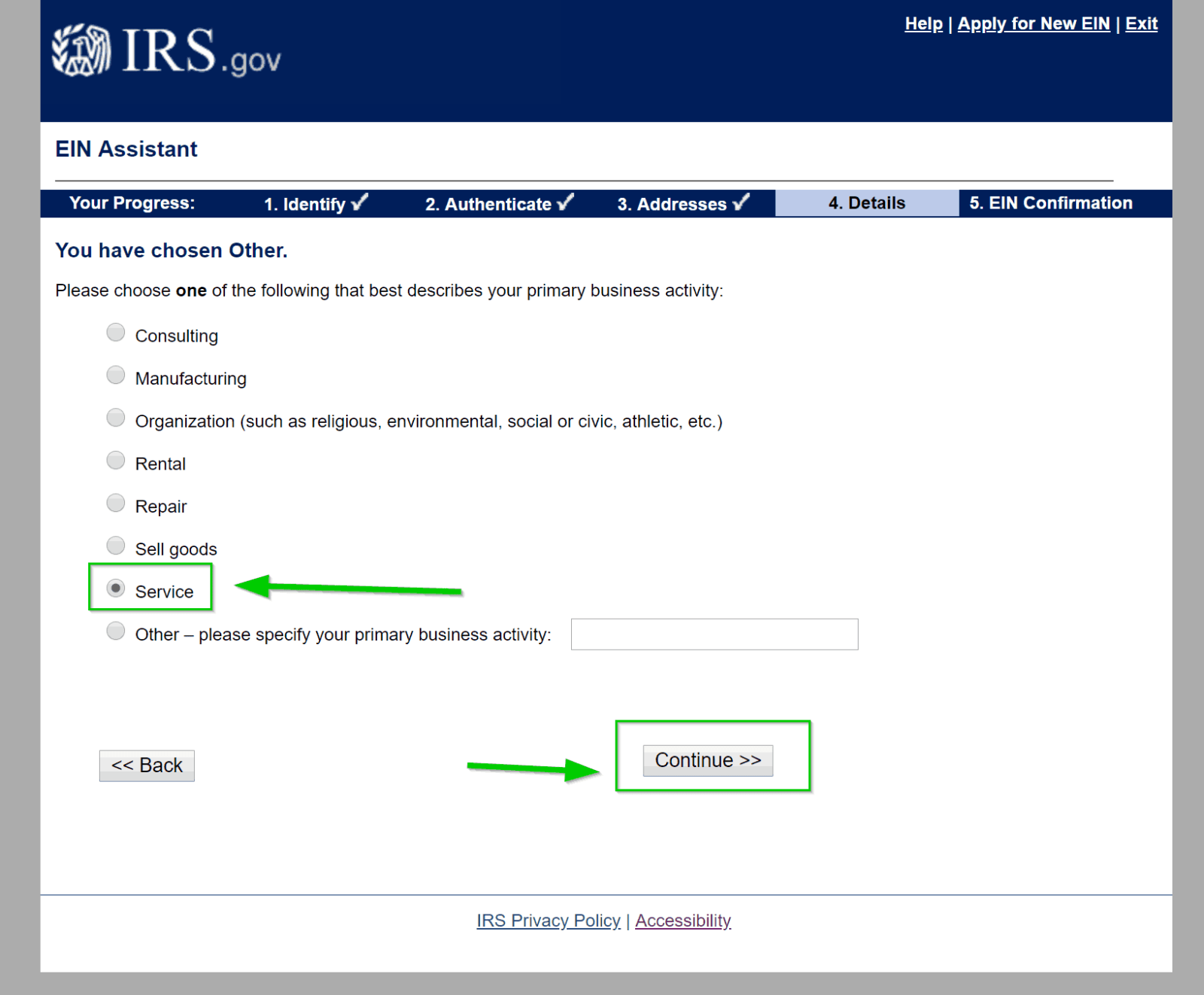

STEP 11

After selecting “Other” the next page will ask for a better description. Select “Service” on this page.

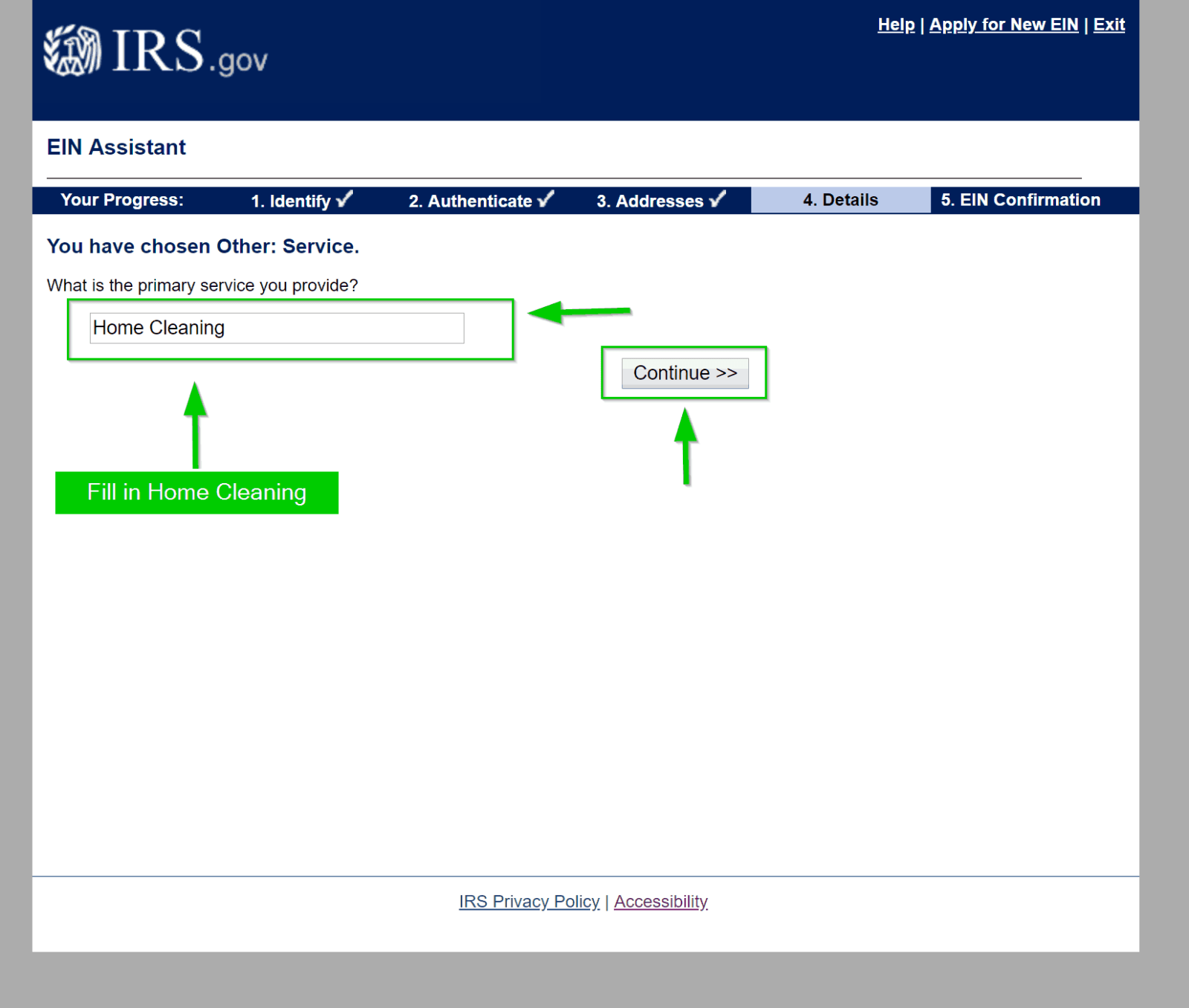

STEP 12

The next page will ask for which service you provide. Fill in the box with “Home Cleaning” and continue.

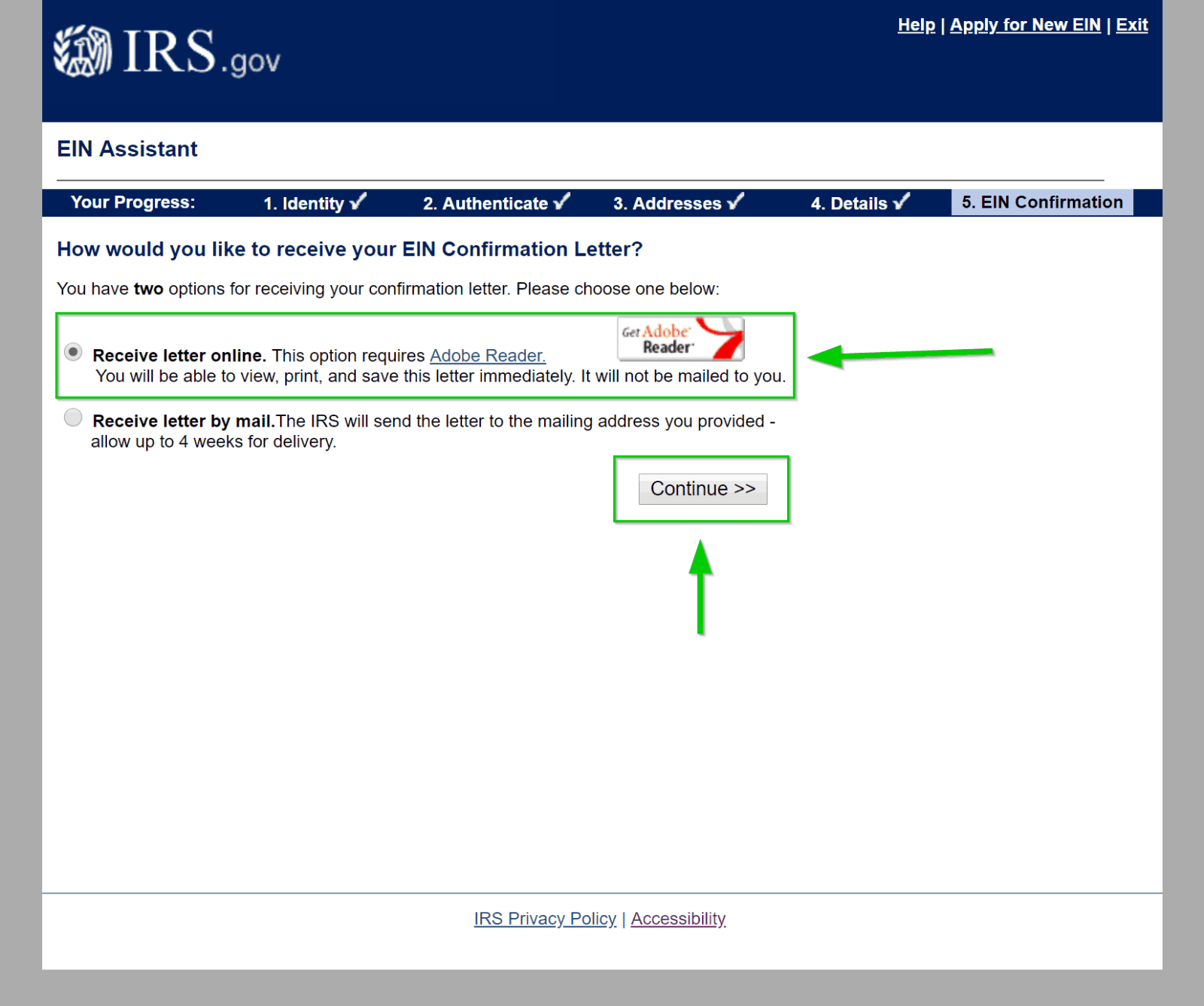

STEP 13

On the next page, they will ask how you’d like to receive your EIN number. Select REceive Letter online. This will be the quickest option for getting your EIN number.

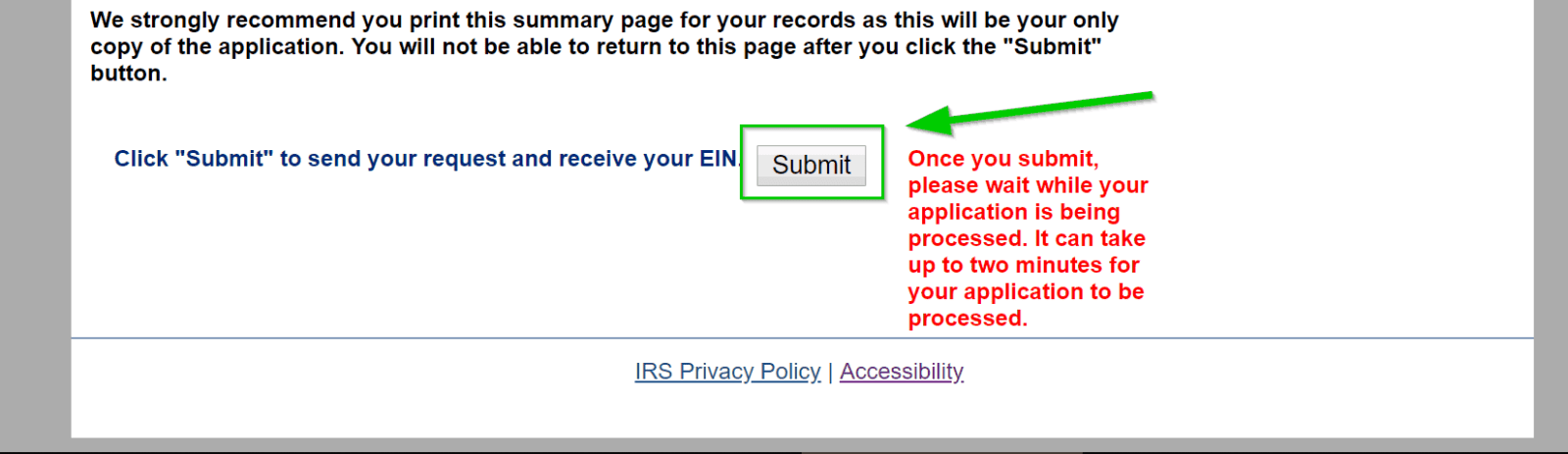

STEP 14

The next page will give a summary of the information provided. Review this and make sure everything is entered correctly. If everything is correct, scroll to the bottom and hit the “Submit” button.

This may take some time. Be patient and wait for the next screen to load.

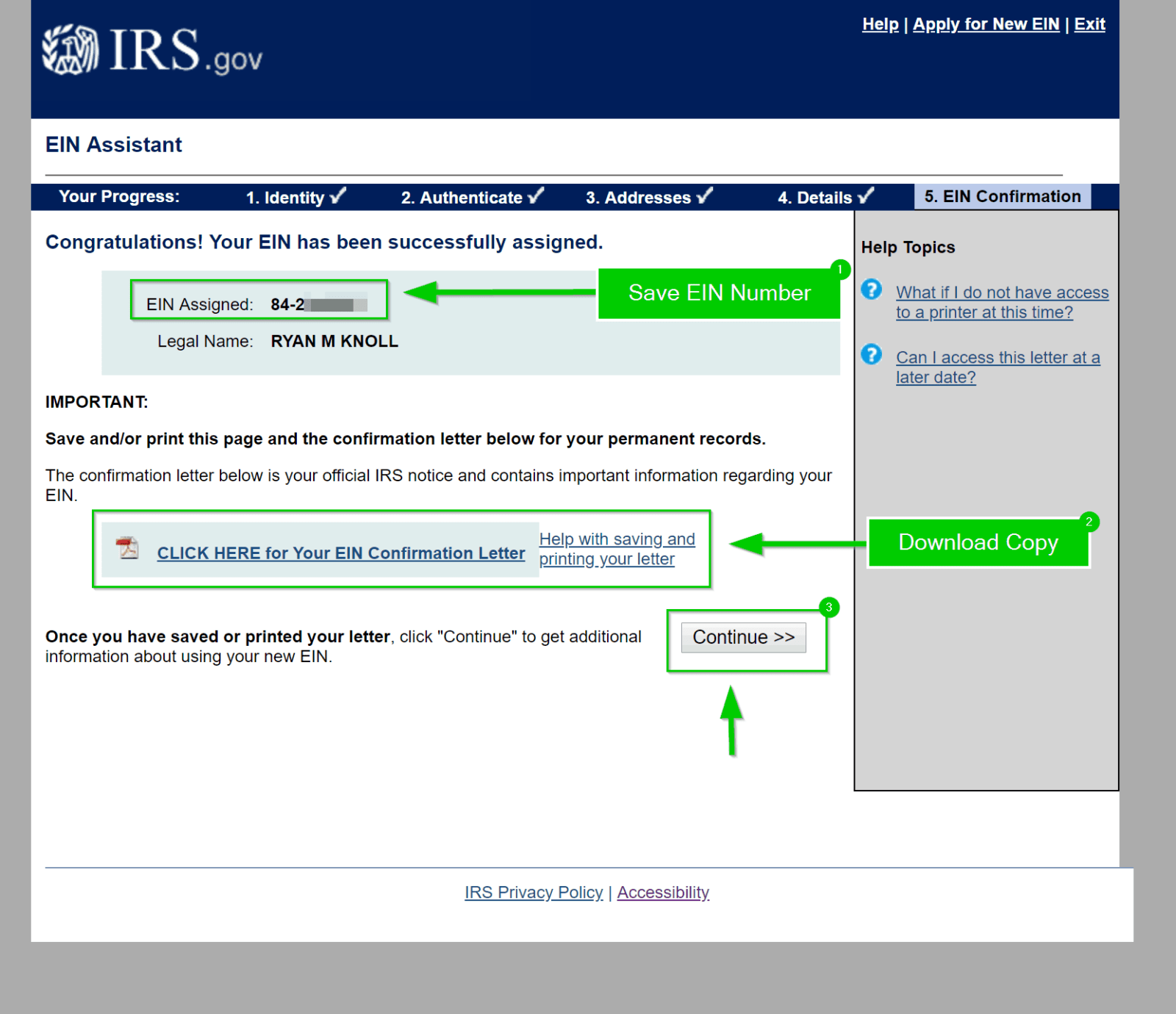

STEP 15

Once submitted the next page will display your EIN number and a button to download the EIN number.

SAVE THIS NUMBER.

This is the number we will use to submit information to the IRS as opposed to your SSN.

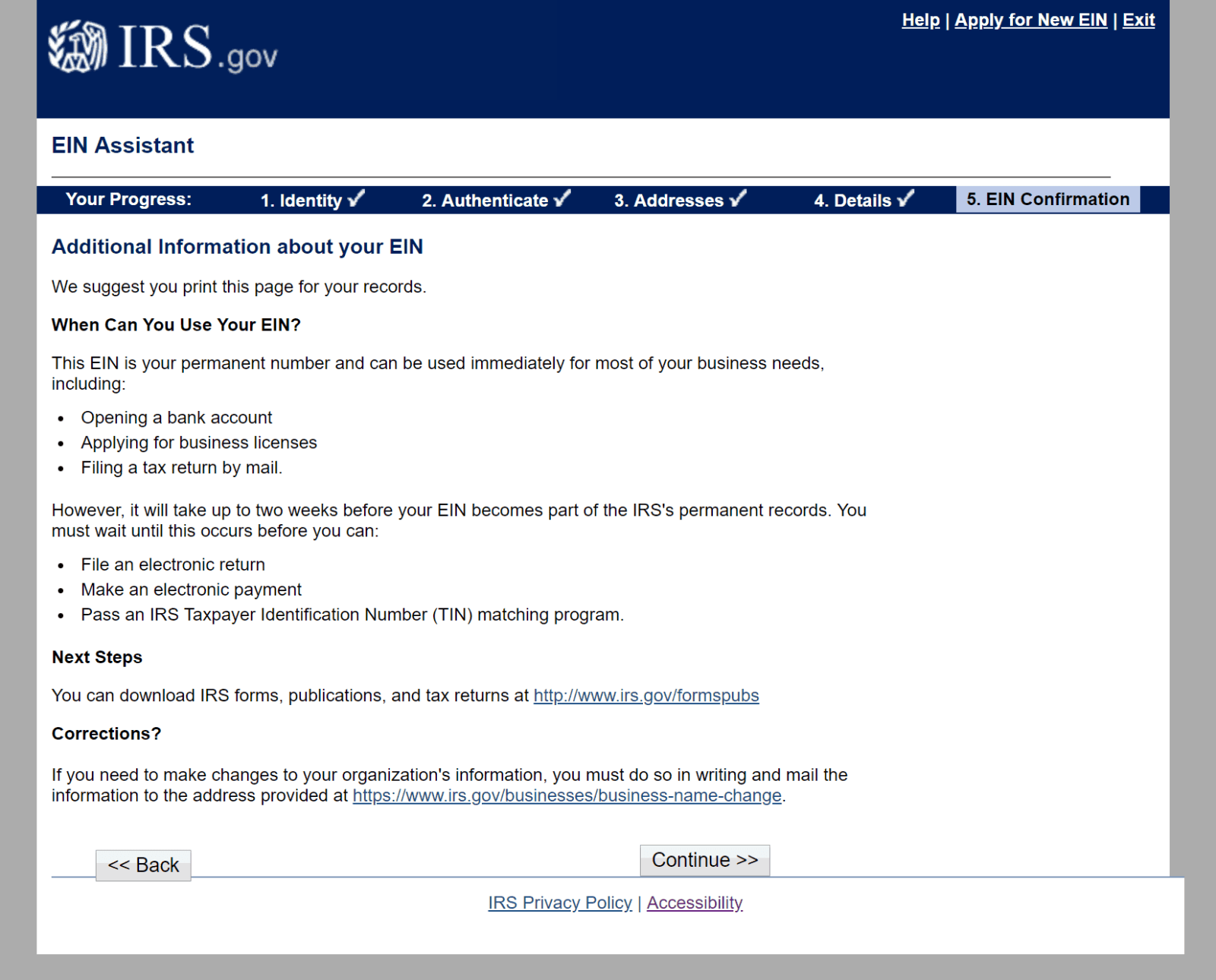

STEP 16

The following page contains important information that you should note for future use of your new EIN number.

Hit continue one more than, then you’ve completed your EIN application. Send us the EIN information via email, text or phone call so we can update your records ASAP.